Financial Reporting Explained: Income Statement

Introduction to Income Statement

Most small business owners know of the income statement which is also referred to as the profit and loss statement. The income statement is used for, “reporting a company’s financial performance over a period of time.” The income statement can be presented in cash basis and in accrual basis. The income statement can contain four distinct sections: Income, Cost of Goods Sold/Cost of Labor, Operating Expenses, and Other Income/Other Expenses.

Accrual Basis vs Cash Basis

The basis of accounting, “refers to the methodology under which revenues and expenses are recognized in the financial statements of a business.” The two main methodologies used are cash basis and accrual basis.

Accrual Basis

The accrual basis methodology recognizes revenue and expenses that have been incurred whether or not they have been paid. This methodology allows for the recognition of bad debt and follows the matching principle. The matching principle states that revenue and expenses should be recognized at the same time.

The importance of using this methodology for small business comes to play when considering gross profit. For most businesses, there is a relationship between income and cost of goods sold/cost of labor. The revenue and the related expenses may not necessarily happen at the same time. A company may pay contractors ahead of the period when the revenue gets posted to the income statement. It’s important to have an idea of a company’s gross profit to determine the amount of profit needed to meet normal operating expense obligations. As a small business owner, if you accrue your expenses and income, it’s important to review your A/R aging and A/P aging schedules to determine your companies ability to collect funds from customers and pay vendors in a timely manner.

Cash Basis

The cash basis methodology recognizes revenue and expenses when they are collected and paid out, respectively. This methodology is simpler for business owners to understand, because it’s a matter of recording cash in and cash out transactions, and helps small business owners get an accurate picture of cash on hand without complex reports.

The importance of using this methodology for small businesses comes into play in understanding cash balances as well as understanding taxable income (except C-corporations). Using cash basis accounting allows business owners to easily estimate their taxable income generated by the business. The drawback to using this methodology is that it may not portray the health of the company accurately.

Most accounting systems allow for business owners to switch between both methodologies so there’s no need to choose one over the other.

Income Statement Sections

Income/Revenue

The income/revenue section of the income statement is the first section, which presents a summary of all income generating activities for the main business operations. This section can be as detailed as separating each line of revenue generating activities, or simply named, “Revenue/Sales.” For smaller businesses this section is usually very general and combines the income generated from goods and services sold to customers.

Cost of Goods Sold/ Cost of Labor

Cost of goods sold or Cost of Labor relates to goods or labor expenses incurred specifically due to a revenue generating activity. If there is no revenue, the assumption is that Cost of Goods Sold/Cost of Labor would not exist. Not all income statements require this section. For many businesses this is important to segment for the purpose of tracking gross profit, as well as determining if they are charging enough for their goods or services to cover these incurred expenses and operating expenses.

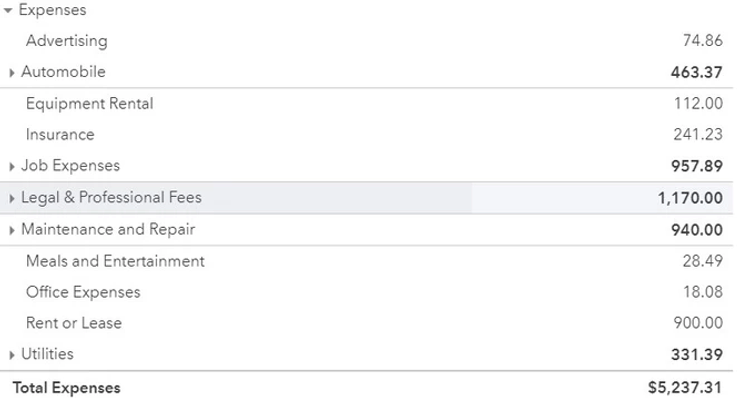

Operating Expenses

Operating expenses are expenses that are generated regardless of income generation. Some examples include general and administrative expenses, such as dues and subscriptions and officer salaries. Similar to the income/revenue section, small business owners have the freedom to make this section as detailed and as general as necessary for their businesses. Many small business owners use sections from their business tax returns as a basis of this section of their income statements. The important thing to note is to make sure this section accurately displays the operating expenses of your business without becoming overwhelming.

Other Income/Other Expenses

This section is where non-operating income and expenses are listed. This isn’t a required section of the financial statements, but serves a purpose to small business owners who want to make sure to separate operating activities from non-operating activities. Examples of non-operating income includes interest income earned from accounts, and other miscellaneous income. Non-operating expenses include expenses that are incurred outside of normal business activities such as depreciation and interest expense.

Importance of Understanding your Income Statement

As a small business owner, it’s important to understand your income statement, the information within this statement can influence decision making around your business operations. Information such as gross profit/gross income (or loss), operating profit/operating income (or loss), and net income/net profit (or loss) can assist you in understanding how to make decisions such as lowering expenses or increasing revenue to meet your business goals.

Gross Profit shows how much your business has to support/contribute it’s operating expenses.

Operating Income is the amount that remains after paying for operating expenses

Net Profit/Loss shows how much the business has to invest in other business activities such as future operating activities mentioned above, financing activities (such as repaying loans) or invest activities (such as purchasing long term assets).

Consider the income statement the first stop in understanding financial reporting and how to use this information for your business.